Welcome back Meta-Traders.

Do you have an edge in the markets? I've often heard it said that if you don't know what your edge is, than you probably don't have one!

Forex Trading presents a great opportunity to find and develop an edge. There are also some inherent advantages to Forex trading on the Meta-Trader platform, particularly if you know the tricks. And the tricks are not 100% about trading strategy itself. What am I talking about? Read on.

Trick #1Use a broker-paid deposit bonus. Every dollar deposited to the accounts followed here has been been paid at least a 5% deposit bonus. That means that if you deposit $1000, the broker will put in an extra $50 and you have $1050 to trade. This doesn't mean you can deposit $1000 on Monday and withdraw $1050 on Wednesday. There are often conditions that the broker must earn at least as much as they paid you in bonus before you can withdraw the funds. But if you have a long-term perspective and a good trading edge, this should not be a problem.

Do I consider deposit bonus to be part of the total return? Absolutely! It may not show up in the account performance on the right side of the blog, but it will be considered part of total return shown in my end of year blog post.

Not all brokers pay a deposit bonus. Do your homework and find one that does before you give them your money.

Trick #2Use Pip Rebates. When you open an account with your Forex broker, do it through an Introducing Broker often abbreviated an IB. That allows the IB to capture a portion of the broker's revenue. And if you pick the right Introducing Broker, they will split the proceeds with you, the trader. This means that you capture a portion of the bid-ask spread which (when you don't open your account through an IB) by default goes 100% to your Forex Broker!

If you use an IB, then a portion of that money goes to the IB. And if you select the right IB, they will pay you a portion of the Pip rebates. If you are not using an IB that pays Pip rebates, find another setup, because you are giving away profits!

For all of my live trading, I use

Trader's Choice FX. These guys pay $5 US for each 100K lot. This may not seem like much, but for systems which trade a lot, this can add up. For my own Expert Advisor FX-Regression, this adds up to about 0.5% of the account per month or about 6% return per year - aside from the gains returned by the expert!

To see this affect in action, check out the deposit made to my FX-Regression account between the 28th and 30th of each month. For my $1000 account, the bonus payment is about 0.5% per month or 6% per year. What affect does this have on the total return of the account? As of 12/16/2011, this account is up 7.47% for the year, but the actual account balance is just over 10%. Pip rebates clearly favor accounts that trade often.

For the record, I have no affiliate relationship with Traders Choice FX, and getting them to pay the promised bonus can sometimes be like pulling teeth. They won't make starting bonus payments which amount to less that $20. So sometimes you have to wait many months, then go back to them for pip rebates earned in prior months. I am in this situation with my FXDD accounts which have never received a bonus payment, and if all goes well should get a fat payment toward then end of this month. Once the account is setup, they will deposit the bonus directly into your trading account (like you see above for my Forex Regression account) for trades executed 2 months prior.

Of course you can skip this step and open an account directly with the Forex broker, but then you are just giving away a portion of your profits.

Tip #3Develop a trading edge.

In my humble opinion, trading Forex is incredibly hard. Sometimes a pair will move 50 pips in 2 minutes, but most of the time, they just slosh around within their daily range 24 hours a day, 5 days a week. I can't think of market more prone to false breakouts, whipsaws, head fakes and just plain old untradable conditions. I simply don't have the time to spend watching, analysing and trading the markets. That doesn't mean I don't want to work hard on trading, it just means I don't want to trade manually.

In his excellent book

Trading in the Zone, Mark Douglas reduces trading to something along the lines of finding your edge in the markets and executing it regularly, relentlessly and without hesitation. That can be a challenge for anyone to do manually. We are all human and our human needs, mental, physical and psychological all stand in the way of proper trading.

Fortunately, Meta-Trader comes to our rescue here by automating the trading process. But you need to carefully follow a process that goes something like this:

1) Find a system that provides a tradable edge. Get to know the system including key characteristics such as entry and exit conditions, average 10 year returns, expected drawdown in both quantity and duration. Obviously,

Asirikuy is a huge help here.

2) Run the system in demo mode for at least 3 months and monitor its performance.

3) Once you are satisfied the system is running properly, start it with real money and off you go!

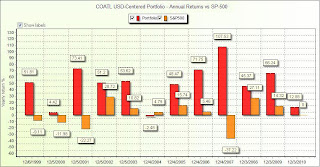

Finally, keep your expectations reasonable. I consider a 10% annual return to be pretty good, but my target is 30-60%. I suspect my annual return for 2011 will be something closer to 20%. Check back around the first of the year for my 2011 wrap-up post.

And yes, be patient. Being a Doctor, Lawyer, Athlete or anything else worth doing takes time. Consider making a trading plan. My 5-year plan can be found in my blog post

Forex Trading, my 5-year plan. I'm about to begin year 3 of my 5 year plan.

What's my long term objective? To be able to live off the forex markets as follows. If have have a million dollars under management, and I can make 20% return, that $200,000 per year, and yes, I can live comfortably on that much.

Take care and enjoy your weekend.

Welcome back Meta-Traders and Happy New Year!

Welcome back Meta-Traders and Happy New Year!