Welcome back Active Traders and Wealth Builders.

Recall from last week's post Crapple no more, we went into the weekend long AAPL shares and call contracts, and short the put 505/500 put credit spread. We took profits on both option positions but held onto the shares. Not only that, we added to the position. Was this a good idea?

When it comes to investing and trading, I often shoot first and ask questions later. That's because the price action itself is a leading indicator, but there are other factors at play. What other factors? Seasonality of course. So I set off on a seasonality study in AAPL to answer these questions:

- Are there specific season patterns in AAPL stock price?

- Does AAPL rally more at certain times of the year versus others?

- What about seasonal sell-off described in my prior post Evidence of Autumn? Based on that, isn't this a bad time of year to be long AAPL stock?

First a brief history lesson on AAPL stock. APPL came public back on December 12, 1980 at a split adjusted price of $3.60 per share. With today's close at around $500 per share, that's about 16.7% annualized return, not bad by any measure. But it has not always been a straight up ride since the stock was under $10 per share back in 2002 when it was basically rescued by a cash-infusion from rival Microsoft. Calculating the rate of return from that low, the rate of return was just under 47% per year.

Back to our seasonality study, to the right find the average weekly YTD returns for APPL shares for the 32 years they have been publicly traded. The chart bears some resemblance to the overall market returns described in my post Evidence of Autumn with these key differences:

- Average annual return for AAPL was nearly 35.5% versus about 7.5% for the Dow Jones Industrials

- The Dow has its autumn sell-off between weeks 35 and 43 and gave back about 24% of its year to date gain in that 8 week period

- AAPL has its autumn sell-off between weeks 37 and 40 and gave back about 18% of its gain in that 3 week period

- From week 40 through the end of the year, AAPL makes 45% of its annual gain while the Dow makes 29% of its annual gain in that same exact time period.

To summarize, the autumn sell-off in AAPL shares occurs about 2 weeks later than the general market and ends 3 weeks sooner. Not only that, the sell-off is more shallow in duration that the rest of the market. Once the sell-off is complete, AAPL continues on to make the bulk of its annual gain between weeks 40 and 52 and gains much more than the general market on average.

Based on all that, I will stay long AAPL shares for the time being.

Enjoy your weekend.

Friday, August 23, 2013

Saturday, August 17, 2013

Active Trader - Crapple No More

Welcome back Active Traders and Wealth Builders.

Recall in my post Apple Trendline break back on May 4, 2013 that market leader AAPL had turned the corner on its massive sell-off from the $700 level which began in September of 2012. The shares have moved more or less sideways since then at one point selling off and re-testing the lows back to the $388 level but ending last Friday right at the resistance area of $465 - not far from where they were back in May.

Everything changed on Tuesday when the shares opened in at $471, quickly traded back to resistance at 468 then reversed and headed steadily higher. Then at 11:21 AM, Carl Icahn tweeted:

@Carl_C_Icahn - We currently have a large position in APPLE. We believe the company to be extremely undervalued. Spoke to Tim Cook today. More to come.

That got the shares moving and by about 2 PM they were up in the 475 range. Then at about 2:21 PM, Icahn tweeted again:

@Carl_C_Icahn - Had a nice conversation with Tim Cook today. Discussed my opinion that a larger buyback should be done now. We plan to speak again shortly.

That second tweet really lit a fire under the stock and it traded up $10 to about $485 within minutes of this tweet.

Twitter has been gaining prominence in the trading and investing community, but this was a first - a high profile billionaire activist investor releasing market-moving information via Twitter. This second tweet caused an increase of nearly 10 billion in Market Cap in just minutes.

The shares traded up to as high as $495 on Tuesday but settled back and closed just under the $490 area. John Carter came into the Simpler Options room on the close and recommended the 485/490 PCS for about a $2 credit. I didn't take the trade but he expected to see follow-through to the upside in the shares the next day.

Mr Carter was right and the shares opened at $495 on Wednesday and quickly traded up to $500 and bounced around that level for more or less the remainder of the week, hemmed in somewhat by Friday's monthly options expiration. Then in Friday's Simpler Options Trading room John put on a number of bullish positions in AAPL, expecting further follow-through and a gap up on Monday. I followed through as follows:

- Short the Aug 23 Weekly 500/505 put credit spread for a credit of 2.65

- Long the AAPL Aug 23 Weekly 490 calls at 14.30

- Long the shares in both cash and retirement accounts

JC expects a gap up on Monday with a move quickly to the 513 area before consolidating and I am positioned for that to occur. Anything can happen of course, but JC's ability to see a high probability of continuation, and position himself in advance of it is one of his key money-making techniques.

One other take away from this week - Twitter has become a big and serious player in Social Media. With everyone from the Pope to President Obama to Carl Icahn using the medium, its no joke. As it turns out you can say an awful lot in less than 140 characters. More to come on the Twitter IPO.

Enjoy your weekend and the fruits of your labors.

Recall in my post Apple Trendline break back on May 4, 2013 that market leader AAPL had turned the corner on its massive sell-off from the $700 level which began in September of 2012. The shares have moved more or less sideways since then at one point selling off and re-testing the lows back to the $388 level but ending last Friday right at the resistance area of $465 - not far from where they were back in May.

Everything changed on Tuesday when the shares opened in at $471, quickly traded back to resistance at 468 then reversed and headed steadily higher. Then at 11:21 AM, Carl Icahn tweeted:

@Carl_C_Icahn - We currently have a large position in APPLE. We believe the company to be extremely undervalued. Spoke to Tim Cook today. More to come.

That got the shares moving and by about 2 PM they were up in the 475 range. Then at about 2:21 PM, Icahn tweeted again:

@Carl_C_Icahn - Had a nice conversation with Tim Cook today. Discussed my opinion that a larger buyback should be done now. We plan to speak again shortly.

That second tweet really lit a fire under the stock and it traded up $10 to about $485 within minutes of this tweet.

Twitter has been gaining prominence in the trading and investing community, but this was a first - a high profile billionaire activist investor releasing market-moving information via Twitter. This second tweet caused an increase of nearly 10 billion in Market Cap in just minutes.

The shares traded up to as high as $495 on Tuesday but settled back and closed just under the $490 area. John Carter came into the Simpler Options room on the close and recommended the 485/490 PCS for about a $2 credit. I didn't take the trade but he expected to see follow-through to the upside in the shares the next day.

Mr Carter was right and the shares opened at $495 on Wednesday and quickly traded up to $500 and bounced around that level for more or less the remainder of the week, hemmed in somewhat by Friday's monthly options expiration. Then in Friday's Simpler Options Trading room John put on a number of bullish positions in AAPL, expecting further follow-through and a gap up on Monday. I followed through as follows:

- Short the Aug 23 Weekly 500/505 put credit spread for a credit of 2.65

- Long the AAPL Aug 23 Weekly 490 calls at 14.30

- Long the shares in both cash and retirement accounts

JC expects a gap up on Monday with a move quickly to the 513 area before consolidating and I am positioned for that to occur. Anything can happen of course, but JC's ability to see a high probability of continuation, and position himself in advance of it is one of his key money-making techniques.

One other take away from this week - Twitter has become a big and serious player in Social Media. With everyone from the Pope to President Obama to Carl Icahn using the medium, its no joke. As it turns out you can say an awful lot in less than 140 characters. More to come on the Twitter IPO.

Enjoy your weekend and the fruits of your labors.

Sunday, August 11, 2013

Active-Trader - Evidence of Autumn

Welcome back, Active Traders and Wealth Builders.

"History recalls how great the fall can be, while everybody's sleeping, the boats put out to sea. Borne on the wings of time, It seemed the answers were so easy to find. Too late, the prophets cry, The island's sinking, let's take to the sky." - Supertramp - Fool's Overture

Of course I am waxing poetic here, but I can't help myself. There is no escape from the cycles of the seasons, and I have taken enough spins around the sun to see this one coming. What the heck am I talking about?

I'm talking about the sell-off in the stock markets that almost inevitable occurs in the late August to October time frame. Plus after the run-up we have had in the averages this year - nearly 20% in the SP-500 - we are more than due for some selling. And we started to see some signs this past week with the Dow Jones Industrial Average posting its first negative weekly return in almost 2 months.

There's plenty of anecdotal evidence of sell-offs in the stock market that come in the autumn months. Notable examples include 1929. 1937. 1966, 1974 and 1987. But every year is different and where we are talking about money nobody, wants to hear anecdotes. You want facts, hard evidence - you want rigor, right?

Well fear not blog readers since I went on a search for some answers and using the awesome data analysis tools at my disposal here's what I came up with. The goal was to determine - is there clear numerical evidence that the stock market sells off in the autumn months?

I started with TradeStation and pulled up a weekly chart of the Dow Jones Industrial Average. I chose the Dow because it has more history than any other index and has weekly data all the way back to 1920. Next, I created an indicator in EasyLanguage which plots the year-to-date returns of the average as an indicator on the chart. This was basically a two-liner in TradeStation as follows:

{ Grab last year's close }

dLastYearsClose = CloseY(1);

{ Percentage Change }

dPctChange = ((Close - dLastYearsClose)//dLastYearsClose*100.0);

Next step was to bring up the data window and export the data to a text file where we had the date, the weekly close and the Year-To-Date percentage change for the date.

Next step was to bring the data up in Microsoft Excel and save it as a spreadsheet which makes it slightly easier to import in MS-Access where the real number crunching gets done.

Next steps is to load up the data in Excel and add a column which returns a week number of the data for that week - first week of January is 1, 2nd week is 2, etc. This allows seasonality to be extracted on a broad basis without getting involved in what day of the week the month starts on etc. I used this method with some success in my prior post Fun with Forex Historical.

Next and almost final step was to create a query in MS-Access which groups the data by week number of the year and returns the average historical year-to-date change for that week number of the year. I took that data and put in back into Excel to create this chart.

Let's stop for a second to understand what this chart means. This chart represents the typical stock market year by week of the year using 92 years worth of data which is pretty powerful and useful information.

So there's the information, what are the key takeaways?

- The stock market goes up over time. In other words, there was not a single week of the year with a negative historical return

- There was a noticeable peek at week 35 followed by a trough at week 42, then it was straight up from there through the end of the year. Week 35 corresponds roughly to the first week of September. Week 42 corresponds roughly to the last week of October, or first week of November.

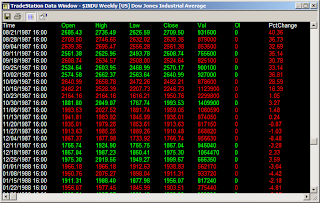

- The sell-off which occurs between these dates - on average - just gives back some of the returns for the year but does not put the overall proposition into the negative. To illustrate this point, take a look at the screen shot of the data window from Tradestation from 1987. The market was up over 40% for the year at the peak on 8/21/1987. And after the historical sell-off ended the year still up +3.59 for the year!

So what does all this mean for my trading and investing? It provides firm historical data which tells me to hold off on making any large long-side commitments between now and the end of August. Wait for the sell-off and ugliness which occurs into the fall. Then pile back into the market and the end of October for the year-end rally.

Like I said above, every year is different and we can't predict the future. But we have some pretty clear evidence of seasonality in the stock market above.

Enjoy your week ahead and keep your power dry - until the end of October.

"History recalls how great the fall can be, while everybody's sleeping, the boats put out to sea. Borne on the wings of time, It seemed the answers were so easy to find. Too late, the prophets cry, The island's sinking, let's take to the sky." - Supertramp - Fool's Overture

Of course I am waxing poetic here, but I can't help myself. There is no escape from the cycles of the seasons, and I have taken enough spins around the sun to see this one coming. What the heck am I talking about?

I'm talking about the sell-off in the stock markets that almost inevitable occurs in the late August to October time frame. Plus after the run-up we have had in the averages this year - nearly 20% in the SP-500 - we are more than due for some selling. And we started to see some signs this past week with the Dow Jones Industrial Average posting its first negative weekly return in almost 2 months.

There's plenty of anecdotal evidence of sell-offs in the stock market that come in the autumn months. Notable examples include 1929. 1937. 1966, 1974 and 1987. But every year is different and where we are talking about money nobody, wants to hear anecdotes. You want facts, hard evidence - you want rigor, right?

Well fear not blog readers since I went on a search for some answers and using the awesome data analysis tools at my disposal here's what I came up with. The goal was to determine - is there clear numerical evidence that the stock market sells off in the autumn months?

I started with TradeStation and pulled up a weekly chart of the Dow Jones Industrial Average. I chose the Dow because it has more history than any other index and has weekly data all the way back to 1920. Next, I created an indicator in EasyLanguage which plots the year-to-date returns of the average as an indicator on the chart. This was basically a two-liner in TradeStation as follows:

{ Grab last year's close }

dLastYearsClose = CloseY(1);

{ Percentage Change }

dPctChange = ((Close - dLastYearsClose)//dLastYearsClose*100.0);

Next step was to bring up the data window and export the data to a text file where we had the date, the weekly close and the Year-To-Date percentage change for the date.

Next step was to bring the data up in Microsoft Excel and save it as a spreadsheet which makes it slightly easier to import in MS-Access where the real number crunching gets done.

Next steps is to load up the data in Excel and add a column which returns a week number of the data for that week - first week of January is 1, 2nd week is 2, etc. This allows seasonality to be extracted on a broad basis without getting involved in what day of the week the month starts on etc. I used this method with some success in my prior post Fun with Forex Historical.

Next and almost final step was to create a query in MS-Access which groups the data by week number of the year and returns the average historical year-to-date change for that week number of the year. I took that data and put in back into Excel to create this chart.

Let's stop for a second to understand what this chart means. This chart represents the typical stock market year by week of the year using 92 years worth of data which is pretty powerful and useful information.

So there's the information, what are the key takeaways?

- The stock market goes up over time. In other words, there was not a single week of the year with a negative historical return

- There was a noticeable peek at week 35 followed by a trough at week 42, then it was straight up from there through the end of the year. Week 35 corresponds roughly to the first week of September. Week 42 corresponds roughly to the last week of October, or first week of November.

- The sell-off which occurs between these dates - on average - just gives back some of the returns for the year but does not put the overall proposition into the negative. To illustrate this point, take a look at the screen shot of the data window from Tradestation from 1987. The market was up over 40% for the year at the peak on 8/21/1987. And after the historical sell-off ended the year still up +3.59 for the year!

So what does all this mean for my trading and investing? It provides firm historical data which tells me to hold off on making any large long-side commitments between now and the end of August. Wait for the sell-off and ugliness which occurs into the fall. Then pile back into the market and the end of October for the year-end rally.

Like I said above, every year is different and we can't predict the future. But we have some pretty clear evidence of seasonality in the stock market above.

Enjoy your week ahead and keep your power dry - until the end of October.

Saturday, August 3, 2013

Active-Trader - One Wild Ride

Welcome back, Active Traders.

It was one heck of a week filled with upside and downside action, and none more than in my favorite credit card processing company Mastercard. Recall that we have been on the case with this stock as early as the first week of 2013 when I mentioned it in my post here when it first crossed 500. I've been trading in and out of it in small lots, usually about 10 share blocks. As of earnings which came out this past Thursday, I was long 20 shares in my cash account and 30 in my retirement account.

Anyway, with the stock at about 600 back on 7/30, I tried to get filled on an Iron Condor similar to what I described in last week's post here. With the Market Maker move at about $20, I was trying to sell the 575/580 put credit spread and the 620/625 call credit spread. For whatever reason, I was just not getting filled so I just went home and called it a day.

Come Wednesday morning, earnings are out and at the stock is trading at about 625 in the pre-market. And much to my surprise, I found out I got filled on the 620/625 call credit spread at 0.90! Just when I thought I had seen it all, here I am filled on a spread that I didn't think I had - and I wake up to find myself at a max loss situation!

Well I learned from experience to keep my cool in situations like this, so I just sat on my hands and watched the stock open. It got to as high as about 626 then slowly started pulling back. By about 11AM, the selling got severe on news that a court had ruled against the US Federal Reserve on its ruling regarding Debit Card fees. That sent the stock into a complete free-fall, trading down to as low as 567 before staging a dramatic reversal and closed the day at 610. Someone in the Simpler Options Trading room followed a comment I make to get long the stock at about 580 and made some serious cash on the quick move back up. I wasn't that fortunate, but was able to cover my 620/625 call credit spread at 0.10 for a profit of 0.80 or about 80 bucks. Not bad considering I was looking at a $400 loss a few minutes earlier.

And as if all that were not enough, the next days the stock roared out to new all time highs and traded up as high as about 645. Had I not covered my CCS on the sell-off, I would have been looking at a max loss situation once again! And I held onto the stock the entire time and sold half of my position up in the 645 area thinking this buying was just of a lot of irrational exuberance.

As for the rest of the week, I had a pretty good time selling spreads into earnings and made a little bit of money (less than $100) every day Monday through Thursday. Come Friday, with LNKD shares at 210, I put on the 185/190, 230/235 condor for a credit of 1.85. At the time this seemed like a no-brainer trade and I figured I had a pretty good chance of ending the week taking home the entire $185.

Well it didn't turn out that way and LNKD instead reported stellar earnings that exceeded everyone's wildest expectations. The stock trade as high as 237 and I ended up buying back the 230/235 Call Credit Spread at 4.5 for a loss of $270. That wiped out most of the profits in my TradeStation account for the week.

Over on the E*Trade side, I had a stellar week with nice gains in the broad market ETF's and solid gains in CBOE, CELG, DNKN and the previously mentioned MA. This pushed my net worth out to new all-time highs. But don't confuse brains with a bull market as the saying goes.

That's all for now, enjoy your weekend and the fruits of your labors.

It was one heck of a week filled with upside and downside action, and none more than in my favorite credit card processing company Mastercard. Recall that we have been on the case with this stock as early as the first week of 2013 when I mentioned it in my post here when it first crossed 500. I've been trading in and out of it in small lots, usually about 10 share blocks. As of earnings which came out this past Thursday, I was long 20 shares in my cash account and 30 in my retirement account.

Anyway, with the stock at about 600 back on 7/30, I tried to get filled on an Iron Condor similar to what I described in last week's post here. With the Market Maker move at about $20, I was trying to sell the 575/580 put credit spread and the 620/625 call credit spread. For whatever reason, I was just not getting filled so I just went home and called it a day.

Come Wednesday morning, earnings are out and at the stock is trading at about 625 in the pre-market. And much to my surprise, I found out I got filled on the 620/625 call credit spread at 0.90! Just when I thought I had seen it all, here I am filled on a spread that I didn't think I had - and I wake up to find myself at a max loss situation!

Well I learned from experience to keep my cool in situations like this, so I just sat on my hands and watched the stock open. It got to as high as about 626 then slowly started pulling back. By about 11AM, the selling got severe on news that a court had ruled against the US Federal Reserve on its ruling regarding Debit Card fees. That sent the stock into a complete free-fall, trading down to as low as 567 before staging a dramatic reversal and closed the day at 610. Someone in the Simpler Options Trading room followed a comment I make to get long the stock at about 580 and made some serious cash on the quick move back up. I wasn't that fortunate, but was able to cover my 620/625 call credit spread at 0.10 for a profit of 0.80 or about 80 bucks. Not bad considering I was looking at a $400 loss a few minutes earlier.

And as if all that were not enough, the next days the stock roared out to new all time highs and traded up as high as about 645. Had I not covered my CCS on the sell-off, I would have been looking at a max loss situation once again! And I held onto the stock the entire time and sold half of my position up in the 645 area thinking this buying was just of a lot of irrational exuberance.

As for the rest of the week, I had a pretty good time selling spreads into earnings and made a little bit of money (less than $100) every day Monday through Thursday. Come Friday, with LNKD shares at 210, I put on the 185/190, 230/235 condor for a credit of 1.85. At the time this seemed like a no-brainer trade and I figured I had a pretty good chance of ending the week taking home the entire $185.

Well it didn't turn out that way and LNKD instead reported stellar earnings that exceeded everyone's wildest expectations. The stock trade as high as 237 and I ended up buying back the 230/235 Call Credit Spread at 4.5 for a loss of $270. That wiped out most of the profits in my TradeStation account for the week.

Over on the E*Trade side, I had a stellar week with nice gains in the broad market ETF's and solid gains in CBOE, CELG, DNKN and the previously mentioned MA. This pushed my net worth out to new all-time highs. But don't confuse brains with a bull market as the saying goes.

That's all for now, enjoy your weekend and the fruits of your labors.

Subscribe to:

Posts (Atom)