Welcome back, Active Traders and Wealth Builders.

Within the past 6 weeks, SPY has been up 8.7% for the year (as of mid September), then October's plunge took it to just barely up 1% for the year. From there we had a fierce bounce back and are now up 6.29% for the year. What a wild few weeks!

This past week was a huge one for earnings. BIIB was the trade of the week where I put on the 310/312.5 - 337.5/340 condor for a credit of 0.98, well past my minimum credit of 30% of the width of the spread. The short strikes are show in red and the long strikes are shown in green on the chart on the left. I put the trade on just before earnings at the blue bar in the middle of the chart.

After hours BIIB traded down hard, well below my short strike as going as low as 290. It was not looking good and I was facing a max loss situation with my short strike almost 20 points underwater.

But I stuck with it and BIIB bounced hard off the lows. It bounced so hard (as a matter of fact) that I sold another PCS (the 302.5/305) on the way back up for a credit of 0.81.. All of those trades went out max profit which is clearly a good thing.

Its a case where adverse excursions outside the market maker move will very often retrace due to the forces of the market makers themselves. We had a very similar situation in AMZN where the stock move against me for a max potential loss in the after hours session, then retraced and closed within the Market Maker Move for a max profit.

All this makes me realize that I'm not at all cut out for day trading. Day trading is more like a hair-trigger video game where the market is brutal and will seek out every stop and shake out every weak money player.

Weekly and monthly options trading is more like a chess game, and a much more forgiving one at that. It doesn't matter how hard the price moves against you. All the matters is the price at expiration and experience has shown that prices will remain within the Market Maker Move the majority of the time. When prices exceed the Market Maker Move (and do so in an impressive fashion such as ALXN this past week) great directional trades are born.

Also notable this week were new all-time highs in AAPL and Facebook (FB). Facebook reports earnings this coming Tuesday after the bell and you know I will be trading that one.

Have a great week ahead.

Saturday, October 25, 2014

Saturday, October 11, 2014

Active Trader - Short against the Box

Welcome back Active Traders.

It was a bruising week for the bulls, with the markets selling off sharply and taking out the recent lows set in mid-August. Even so, the markets have come back to levels set in mid May of 2014.

Taking the long view, the SP-500 has come a long way from the low set during the financial crisis. I ran the numbers and SPY bottomed at 67.10 back in March of 2009 and had its highest closing high at 201.85 back on September 19, 2014. So the SPY is up nearly 200% from that low. Given Friday's close at 190, we are off only 5% of that total move which is not that much.

Since the year 2000, we have had 2 major sell-offs which cut the market nearly in half. I don't expect that type of damage given the perpetually low interest rate environment. However, we clearly could go a lot further to the downside. How to cope with it?

1) Don't let any open positions exceed your pre-defined stop-loss value.

2) Take it from day to day, Focus on what's happening today and trade it.

3) Wait for a rip-the-shorts-heads-off rally, then put on an offsetting position. This past Tuesday was a perfect opportunity where the market ripped to the upside then stalled out right at the top of a declining trend channel.

The quickest and easiest move is to short-against-the box or simply sell short an equal amount of what you are long. This has the following advantages:

But don't overstay on the short side since on a longer term basis the odds are not in your favor.

But don't overstay on the short side since on a longer term basis the odds are not in your favor.

At most, you are going to catch only part of the down move and that's okay.

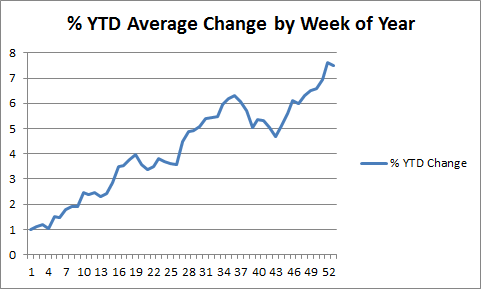

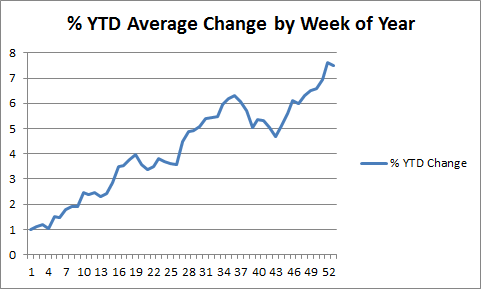

Just hearken back to the Average Change by Week of Year chart from my post Evidence of Autumn. Looking at this chart, you will see that the market tends to sell off during this period, but on average, closes higher by the end of the year.

So don't get too bearish and abandon all your longs, because history shows your losses will recovered and your account will eventually go on to higher highs.

So tread lightly for the remainder of October, it will be November in a few short weeks. Have a great week ahead.

It was a bruising week for the bulls, with the markets selling off sharply and taking out the recent lows set in mid-August. Even so, the markets have come back to levels set in mid May of 2014.

Taking the long view, the SP-500 has come a long way from the low set during the financial crisis. I ran the numbers and SPY bottomed at 67.10 back in March of 2009 and had its highest closing high at 201.85 back on September 19, 2014. So the SPY is up nearly 200% from that low. Given Friday's close at 190, we are off only 5% of that total move which is not that much.

Since the year 2000, we have had 2 major sell-offs which cut the market nearly in half. I don't expect that type of damage given the perpetually low interest rate environment. However, we clearly could go a lot further to the downside. How to cope with it?

1) Don't let any open positions exceed your pre-defined stop-loss value.

2) Take it from day to day, Focus on what's happening today and trade it.

3) Wait for a rip-the-shorts-heads-off rally, then put on an offsetting position. This past Tuesday was a perfect opportunity where the market ripped to the upside then stalled out right at the top of a declining trend channel.

The quickest and easiest move is to short-against-the box or simply sell short an equal amount of what you are long. This has the following advantages:

- Your position is effectively flattened - minus commissions of course

- You avoid capital gains taxes on your taxable accounts

- In your IRA you can just sell the shares since you don't have the problem with capital gains tax.

But don't overstay on the short side since on a longer term basis the odds are not in your favor.

But don't overstay on the short side since on a longer term basis the odds are not in your favor. At most, you are going to catch only part of the down move and that's okay.

Just hearken back to the Average Change by Week of Year chart from my post Evidence of Autumn. Looking at this chart, you will see that the market tends to sell off during this period, but on average, closes higher by the end of the year.

So don't get too bearish and abandon all your longs, because history shows your losses will recovered and your account will eventually go on to higher highs.

So tread lightly for the remainder of October, it will be November in a few short weeks. Have a great week ahead.

Friday, October 3, 2014

Active-Trader - Fib Lines Improvements

Welcome back Active Traders.

In response to a comment from my friend Franklin, I started to contemplate ways to improve the drawing and calculation of fib levels. If you have not read my prior posts on the topic, go back and take a look because I have found fib lines to be the single most significant discovery in all my years of watching the markets.

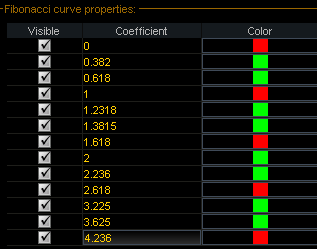

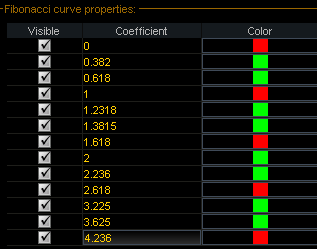

My first idea was to write a script in Thinkorswim - In a language I believe they call it Thinkscript. But then it occurred to me there's a much simpler approach. Simply configure the settings inside the Fib Extensions tool to draw not just the major (red) lines, but also to draw all the subsequent green and white lines.

To make that happen, I needed to calculate all the subsequent lines as as percentage of the original 100% move. In other words, instead of drawing the 1 and 1.618 lines, then drawing the lower lines at 38.1 and 61.8, simply calculate the levels for the intermediate (tree) lines and just add those to the Fib Extensions tool in Thinkorswim.

To calculate the levels, I wrote a recursive algorithm in C# which calculates the levels to an arbitrary level of depth, but stopped at 3, I figured the levels would work as follows:

Fire Lines

0 - Tree Lines

1 - Snow Lines

2 - Minor Lines (no name for these that I am aware of).

Here is what the output looked like for the lines between 1.0 and 1.618:

Lowerline: 1.2361 Upperline: 1.3819 Level: 0

Lowerline: 1.0902 Upperline: 1.1459 Level: 1

Lowerline: 1.0345 Upperline: 1.0557 Level: 2

Lowerline: 1.1115 Upperline: 1.1246 Level: 2

Lowerline: 1.1804 Upperline: 1.2016 Level: 2

Lowerline: 1.2918 Upperline: 1.3262 Level: 1

Lowerline: 1.2574 Upperline: 1.2705 Level: 2

Lowerline: 1.3049 Upperline: 1.3131 Level: 2

Lowerline: 1.3475 Upperline: 1.3606 Level: 2

Lowerline: 1.4721 Upperline: 1.5278 Level: 1

Lowerline: 1.4164 Upperline: 1.4376 Level: 2

Lowerline: 1.4934 Upperline: 1.5065 Level: 2

Lowerline: 1.5623 Upperline: 1.5835 Level: 2

Then I went to enter all those into the Fib Extensions tool in Thinkorswim I figure I could make the minor lines lighter lines with dashes, etc so the lines would not overwhelm the chart. But I quickly learned that the Fib Extensions tool in Thinkorswim was limited to 15 arcs. Sigh, so much for that plan.

Then I went to enter all those into the Fib Extensions tool in Thinkorswim I figure I could make the minor lines lighter lines with dashes, etc so the lines would not overwhelm the chart. But I quickly learned that the Fib Extensions tool in Thinkorswim was limited to 15 arcs. Sigh, so much for that plan.

In any event I came up with the following configuration which includes the red and green lines and calculate those automatically when you highlight wave 1. Using those, I was able to draw the fib lines for IWM. The red and green lines drew automatically, but I had to draw the snow lines manually due to the 15 arc limit in Thinkorswim.

In the end, it looks like the Thinkscript might be a better solution, but this is somewhat of an improvement.

Have a great weekend and week ahead.

In response to a comment from my friend Franklin, I started to contemplate ways to improve the drawing and calculation of fib levels. If you have not read my prior posts on the topic, go back and take a look because I have found fib lines to be the single most significant discovery in all my years of watching the markets.

My first idea was to write a script in Thinkorswim - In a language I believe they call it Thinkscript. But then it occurred to me there's a much simpler approach. Simply configure the settings inside the Fib Extensions tool to draw not just the major (red) lines, but also to draw all the subsequent green and white lines.

To make that happen, I needed to calculate all the subsequent lines as as percentage of the original 100% move. In other words, instead of drawing the 1 and 1.618 lines, then drawing the lower lines at 38.1 and 61.8, simply calculate the levels for the intermediate (tree) lines and just add those to the Fib Extensions tool in Thinkorswim.

To calculate the levels, I wrote a recursive algorithm in C# which calculates the levels to an arbitrary level of depth, but stopped at 3, I figured the levels would work as follows:

Fire Lines

0 - Tree Lines

1 - Snow Lines

2 - Minor Lines (no name for these that I am aware of).

Here is what the output looked like for the lines between 1.0 and 1.618:

Lowerline: 1.2361 Upperline: 1.3819 Level: 0

Lowerline: 1.0902 Upperline: 1.1459 Level: 1

Lowerline: 1.0345 Upperline: 1.0557 Level: 2

Lowerline: 1.1115 Upperline: 1.1246 Level: 2

Lowerline: 1.1804 Upperline: 1.2016 Level: 2

Lowerline: 1.2918 Upperline: 1.3262 Level: 1

Lowerline: 1.2574 Upperline: 1.2705 Level: 2

Lowerline: 1.3049 Upperline: 1.3131 Level: 2

Lowerline: 1.3475 Upperline: 1.3606 Level: 2

Lowerline: 1.4721 Upperline: 1.5278 Level: 1

Lowerline: 1.4164 Upperline: 1.4376 Level: 2

Lowerline: 1.4934 Upperline: 1.5065 Level: 2

Lowerline: 1.5623 Upperline: 1.5835 Level: 2

Then I went to enter all those into the Fib Extensions tool in Thinkorswim I figure I could make the minor lines lighter lines with dashes, etc so the lines would not overwhelm the chart. But I quickly learned that the Fib Extensions tool in Thinkorswim was limited to 15 arcs. Sigh, so much for that plan.

Then I went to enter all those into the Fib Extensions tool in Thinkorswim I figure I could make the minor lines lighter lines with dashes, etc so the lines would not overwhelm the chart. But I quickly learned that the Fib Extensions tool in Thinkorswim was limited to 15 arcs. Sigh, so much for that plan.In any event I came up with the following configuration which includes the red and green lines and calculate those automatically when you highlight wave 1. Using those, I was able to draw the fib lines for IWM. The red and green lines drew automatically, but I had to draw the snow lines manually due to the 15 arc limit in Thinkorswim.

In the end, it looks like the Thinkscript might be a better solution, but this is somewhat of an improvement.

Have a great weekend and week ahead.

Subscribe to:

Posts (Atom)