Welcome back Meta-Traders.

Welcome back Meta-Traders.This is 6th in our series of reviews of the systems found on Asirikuy. In this review, we tackle Watukushay #6, also known as Quimichi.

Quimichi is a word in Nahuatl - the language of the Aztecs in Mexico - which means mouse. I think the name applies since the system earns un-impressive returns on individual pairs, yet gains its power by replicating its affects across multiple pairs. To analogize to nature, you might be able to trap an individual mouse, but as a group, they are hard to defeat due to their persistence and their sheer numbers.

Quimichi is a trend-following system that runs against the daily charts. The system was designed in part to improve on the performance of Ayotyl – which is Daniel’s implementation of the Turtle Trading system made popular by Richard Dennis and William Eckert back in the early 1980’s.

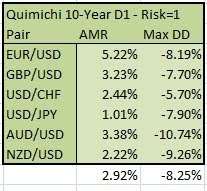

Quimichi runs on the daily charts on pairs EUR/USD, GBP/USD, USD/CHF, USD/JPY, AUD/USD and NDZ/USD. The parameters and rules are exactly the same for each pair which says something for the robustness of the logic. Like all Daniel’s system, the logic is simple and can be explained in a few bullet points:

- Take a long position once the pair makes a close above the highest close for the past X days

- Take a short position once the pair makes a close below the lowest close for the past X days

- Stop out values are Y times the Average True Range

- Take profits occur when the market goes Z consecutive days without closing at a new trend high or low. This may shake the system out of a long-persistent trend early, but the entry logic will re-enter on a subsequent breakout to a new X-day high or low.

What about performance?

What about performance?Given the large number of pairs, I relied on the back-tests posted on Asirikuy rather than running my own. The attached table shows that the average of the AMR (Average Mean Return) across the 6 pairs return just under 3% while the average of the Maximum Drawdown comes to just over 8%. That is not a favorable result and shows that (at least on an individual pairs basis) the system earns about $3 for each $8 in drawdown.

When combined into a portfolio, the 6 pairs perform a lot better and show a combined AMR of 18% with a Maximum Equity Drawdown of 19.4%. Again, the system earns less than in return than it suffers in drawdown. This result does not compare favorably to other systems on Asirikuy such as God’s Gift, Watukushay #2 and Teyacanani which return closer to $2 for every $1 in drawdown.

While the system may not compare favorably based on profit to drawdown, it compares favorably on other dimensions. Its simplicity gives it increased robustness which means increased likelihood that it will continue to work in the future. A few other points:

- System trades on nearly every major currency pair and is therefore less vulnerable to any major change in the Forex market such as restructuring of the European Monetary Union.

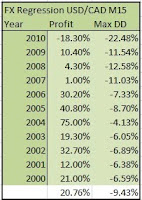

- System trades infrequently and with very large stops and take-profits and is therefore less likely to be affected by broker dependencies and execution related issues. The contrasts particular with my own EA FX-Regression which (according to simulations) earns $2 for every $1 in drawdown but is subject to execution issues and broker dependencies.

- System uses the same parameters on every pair offsetting the potential effects of curve fitting on individual pairs.

Welcome back Meta-Traders.

Welcome back Meta-Traders.