It was a week with some drawdown for the robots I'm following - which isn't surprising after the run of winners we have had recently.

On the global macro side, the equity markets hit what seemed to be a short-term bottom on Tuesday and worked their way higher from there. EUR/USD also held its bottom (made the prior week) in the 1.2150 area. Of course we won't know until later whether this is a real bottom - but then again we don't care because we are system traders and we can make money in any market, right?

A quick housekeeping note - the demo accounts i'm following all expired this week. So I opened up new demo accounts and set the initial deposit equal to the balance on the prior demo at the time of expiration. So the % gains will be based on the starting $1000 account size but unfortunately our trading history has been lost for all except my live Megadroid account.

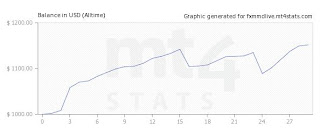

Anyway back to the systems. Megadroid Demo continued to trade like clockwork and picked up 31 pips or about 3% on the week. Megadroid demo is now up a solid 29.4% for the year easily exceeding my 1% per week target.

Megadroid Live got into a bit of trouble on Tuesday. Both MD Live and MD demo bought 0.10 EUR/USD at 1.2348. On the demo side, the trade closed with its 10-pip take profit in a little over 1 hour's time. In the live account, the trade must have missed the TP by just 2 or 3 pips (based on a wider spread in live account) and instead went into drawdown. By the time I went to bed, the position was in 70 pips drawdown and I had no choice but to go to bed and let it ride.

This is a similar situation I've been in the the past few drawdowns with Megadroid. The trade goes 1 of 3 ways.

- The robot takes a 10-pip take profit within an hour or 2.

- The trade goes into drawdown and the robot will close out the trade for any profit whatsoever for about the next 14 hours.

- After 14 hours if the trade still hasn't shown a profit, it will be closed out for whatever loss is on the table at that time.

There is a 4th option and that is that the robot will take the 200 pips stop loss in under 14 hours. Fortunately, I haven't seen that outcome yet.

Anyway, I woke up the next morning and found that most of the 70 pip drawdown had been recovered and I was a mere 10-pips away from exiting this trade with a small profit. So I went to work and later found out that the trade turned back against me and was closed with a -51 pip loss or about 5% of the account. Fortunately the trade size was 0.10 - recall that i'm now managing the 'Recovery Mode' feature myself because this feature in the robot seems to be broken.

So I came home at the end of the day and set the account risk back up to 0.10 so it was now trading double the intended lot size or 0.20. This worked like a champ and the robot took 27 pips out of the market it 3 quick trades, two of which lasted under 10 minutes! So in one day's trading I made back the entire loss which shows the power and accuracy of the Megadroid robot. Also, I set my risk value back down to to 0.05 having recovered this week's drawdown.

In other action, God's Gift GBP/USD took a small, 6-pip profit on Friday and remains up an impressive 18.1% on the year. God's Gift EUR/USD took a 70-pip drawdown but remains up 11.6% for the year

Finally, Megadroid Pro is sucking wind down 27% in just 2 weeks time. Even more suckish is Forex Maximizer which is down a stunning 45.7% is the same 2 weeks. I'll be going after Click Bank for a refund of my $97. Should be interesting to see if they give me any trouble with the refund. Hard to beleive Megadroid and Megadroid pro could be from the same developers.

On a final note, my regular job has kept me busy and both ends of the work day, so I haven't had much chance to do any new robot development. I have some great ideas however regarding multi-timeframe systems so check back later and enjoy your weekend.

Anyway, I woke up the next morning and found that most of the 70 pip drawdown had been recovered and I was a mere 10-pips away from exiting this trade with a small profit. So I went to work and later found out that the trade turned back against me and was closed with a -51 pip loss or about 5% of the account. Fortunately the trade size was 0.10 - recall that i'm now managing the 'Recovery Mode' feature myself because this feature in the robot seems to be broken.

So I came home at the end of the day and set the account risk back up to 0.10 so it was now trading double the intended lot size or 0.20. This worked like a champ and the robot took 27 pips out of the market it 3 quick trades, two of which lasted under 10 minutes! So in one day's trading I made back the entire loss which shows the power and accuracy of the Megadroid robot. Also, I set my risk value back down to to 0.05 having recovered this week's drawdown.

In other action, God's Gift GBP/USD took a small, 6-pip profit on Friday and remains up an impressive 18.1% on the year. God's Gift EUR/USD took a 70-pip drawdown but remains up 11.6% for the year

Finally, Megadroid Pro is sucking wind down 27% in just 2 weeks time. Even more suckish is Forex Maximizer which is down a stunning 45.7% is the same 2 weeks. I'll be going after Click Bank for a refund of my $97. Should be interesting to see if they give me any trouble with the refund. Hard to beleive Megadroid and Megadroid pro could be from the same developers.

On a final note, my regular job has kept me busy and both ends of the work day, so I haven't had much chance to do any new robot development. I have some great ideas however regarding multi-timeframe systems so check back later and enjoy your weekend.