Welcome back Meta-Traders.

Here is part 2 of my review of Coatl from

Asirikuy. This review won’t make a lot of sense unless you read part 1, so if you need a refresher, go back and read part 1

here.

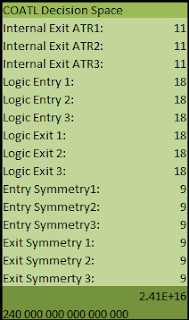

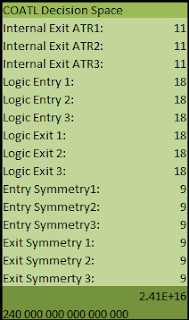

When we left off on part 1, we had a broad sense of what types of values were being optimized, but were only starting to wrap our heads around the size of the decision space. The spreadsheet on the left shows each if the items optimized by COATL and how many choices are considered for each item.

Broadly, here are the items optimized:

- Stop Loss values as a percent of the ATR (choose 1 of 11)

- Logic used for system entry (choose 1 of 18)

- Logic used for system exit (choose 1 of 18)

- Symmetry values for indicator levels for position entry (choose 1 of 9)

- Symmetry values for indicator levels for position exit (choose 1 of 9)

Daniel cuts down considerably on the size of decision space by using “symmetry” values for indicator levels. Symmetry values range between 50 and 90 and for upside crossovers constitute a cross of the actual value (say 80) and for downside crossovers are 100 minus the values, for example 100 minus 80 or 20. This clever use allows both upside and downside values to be optimized in one pass. It also ensures that indicator interpretations are symmetrical, hence the name.

Anyway, when we multiply the number of choices for all the items together, we end up with a decision space of 2.41E * 10^16. Written out in long form, that is 240,000,000,000,000,000 or 240 quadrillion possible combinations. When dealing with numbers that big, you can easily see why scientific notation is required. We don’t see numbers that big in the grocery store (or our bank accounts) but we see them in science and engineering.

To get a sense of what a difference the genetic algorithm makes, I started an optimization without the genetic algorithm box checked, and the system estimated it would take about approximately 795,000 hours. With 24 hours in a day, that comes to 33,125 days and with 365 days in a year, that’s about 90 years! Thus, without the genetic algorithm, it would take a lifetime to optimize just 1 pair! When the genetic algorithm box is checked, the optimization time is reduced to just over 5 hours!

Once you put in the 5 hours optimizing, all the work is done, right? Wrong, now you have 1000’s of optimization results to wade through to find the best choice. If you think this is easy, think again. What you end up with is a “Sparse matrix in Euclidian Space”.

Humans are pretty good at visualizing 2 and 3 dimensional spaces. Once you get beyond 3 dimensions what you get is a “hyper-cube” or a cube with N dimensions. In this particular case, you have a hyper-cube with 15-dimensions.

Meta-Trader helps you handle this challenge in a few different ways:

- MT4 discards the unprofitable results and only keeps the ones that turned a profit. With the 2.4*10^16 choices, the system came up with about 6,000 profitable combinations when optimizing on EUR/USD.

- MT4 shows a running graph of profitable outcomes with instances on the X-Axis and Profit returned on the Y-Axis. Neighboring results are usually nearby in Euclidean space on at least one dimension.

- In the same space as the graph, you can also show a 2-dimensional surface map which shows profitability as a shade of green at the intersection of 2 axis values. The deeper the shade of green, the more profitable.

Using that last feature, you can get an idea of what parameters values are producing profitable systems at the intersection of 2 sides of the hyper-cube. Obviously, you want to find a set of parameter values that are within a broad area of profitability that won’t fall into an area of unprofitability with a small shift it the market.

Overall, trying to interpret this data is one of the most interesting challenges I have come across in the amazing field of Forex trading. Also, I have to think this is one area where Meta-Trader comes up a bit short. I have screen shots from Wealth-Lab where you can fly through a 3-dimensional representations of optimization results. Even so, Meta-Trader is a pretty amazing tool, especially considering the fact that it’s totally free!

Hard as this challenge is, Daniel makes it easier by coming up with a set of parameter that he thinks perform best for each pair. In the case of EUR/USD, all 3 embedded systems use normal MACD crossover for entry, and a combination of long and short-term RSI crossovers for exit. And while on the topic of EUR/USD, let’s take a look at the performance of Daniel’s selected parameters for EUR/USD versus the other systems on Asirikuy. Why EUR/USD? Because it’s the most liquid, has the narrowest spread, and is a good basis for comparison with other systems on Asirikuy.

For a 10-year back test, and 100K invested and a risk unit of 1.0 per trade, 100K grew to about 415K. This comes to about a 13.82% return, but maximum drawdown is nearly 60% - clearly not among the best systems on Asirikuy for EUR/USD on a risk to reward basis. Clearly the risk would have to be dialed down and combined with other pairs and systems to get a more tradable result.

And that’s where the system really starts to shine - on a portfolio basis. There’s a lot to talk about there, so check back next week for the last and final part of my review of Coatl.

Welcome back Meta-Traders.

Welcome back Meta-Traders.