Welcome back Meta-Traders.

Welcome back Meta-Traders.This is the 3rd in our series of reviews of the systems found on Asirikuy. In this review, we tackle Watukushay #3, also known as Kutichiy.

Kutichiy is a word in Quechua (the language used by the Inca and related tribes in South America) which means “answer.” The name comes from the fact that the author considers the system to be the answer to an ongoing search for a weekly breakout system that adapts to the market – versus systems based on fixed breakout, Take Profit and Stop Loss values.

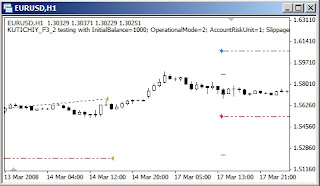

Like all Daniel’s systems, the logic is relatively simple and easy to explain. The system waits a certain number of hours after the Sunday open then enters a buy stop above the market and a sell stop below the market. The distance between the market and the stop orders is set as a multiple of the “box size”. The box size is determined by the range (High-Low) of the preceding X number of bars. Since the system bases the box size on the actual range of the pair, the box size will vary by week. Take profit and stop-loss values are set at a multiple of the box size.

Position sizes are set based on the risk setting (which defaults to 1) and are adjusted for the box size such that the system will make or lose roughly the same amount for each trade as a percentage of account size.

Once stop orders are entered, the system will cancel the orders if they are not filled as of the close of trading that week. Open positions are left open until they hit either the Take Profit, or the Stop Loss which can occur anywhere from days to weeks after the orders are placed. As a result, the system can have multiple orders open at the same time in the same or opposite directions. This means that the system (when trading as designed) is not NFA-compliant since NFA prohibits ‘hedging’ or being long and short the same pair at the same time. The system does have an NFA compliant setting which allows it to be traded under NFA rules, but that affects performance as discussed below.

What about performance?

What about performance?When trading with NFA=False (Hedging allowed), the system returned approximately 13.5% a year over a 10-year period with an average drawdown of about -12.0%. Performance could be improved by increasing the Risk level, but that would also increase drawdown proportionally.

When trading with NFA=True, the system returned about 7.5% per year, but the maximum drawdown for the period was -19% which was the same as the maximum drawdown for the NFA=False system.

On the basis of performance, Kutichiy does not compare favorably to both Watukushay No 2 and God’s Gift ATR which both earn close to 20% per year with average drawdown close to -10%. Both those systems are traded with a higher risk level, but manage to return about $2 for every $1 of risk.

I should mention that Kutichiy is designed to work on many different pairs and contains a setting to fade breakouts as well as buying them. Daniel mentioned that one of his users designed a robots portfolio where one trades Kutichiy on USD/JPY. I tested a few pairs aside from EUR/USD and got mixed results.

All that said, Kutichiy is an interesting addition to the Asirikuy arsenal of trading systems. The most important additions I believe are the following:

- Breakout-based systems should trigger at certain fixed hours of the day and the breakouts should be based on the price action itself. The systems can either buy or sell the breakouts, and Kutichuy has an option for either approach.

- Once open, trade closing should be based on conditions which are not the mirror images of entry conditions both on time and price. SL and TP values are dynamic in the sense that they change from week to week and trades don't necesarily need to be closed every week.

At this point, my robot’s portfolio for 2011 is nearly formed and some of them have already started live trading. I'm not reporting on them just yet since I would like to build up some trading history first.

Check back later for details on that and have a great week!

No comments:

Post a Comment