In my prior blog post, I covered these same 3 stocks, FB, AMZN and NFLX. But they are so interesting, and respect the Fib levels so nicely, the trio is worth another look.

First up in Facebook. After reaching a new all-time high back on March 24 the stock has been in retreat. This past week is found support just 10 cents from the white line at 76.95.

Obviously this stock has under performed recently. But sometimes, the long-term trend trumps any short-term weakness and I remain fully positioned to the long side and have not sold any shares.

Next up is AMZN. After an upside earnings surprise, the stock ripped out to a new all-time high gapping past the 423% line. In my prior post, commented that I expected the stock to fill the gap before resuming its uptrend. But instead, notice how the stock came down and kissed the 423% line then headed straight higher.

I have no position in AMZN, but I am starting to rethink the company. It's not so much about earnings per share. Its about the dominant affect this company is having on retailing. Amazon is disrupting traditional retailing and creating entire new economizes where they facilitate business.

I recently listened to a presentation by a John Carter friend who described how he sets up businesses to sell things on Amazon. He selects the products and has the manufactured and shipped to Amazon who handles the fulfillment and shipping. He never has to handle the the inventory and his risk is limited more or less the price he paid for the inventory. Of course he was also selling a course and mentor ship for $5000 where you could learn to do the same. I passed on that of course, but the impression is made was palpable.

Think about this for a second. If you wanted to buy something, and knew more or less what you wanted, why not buy it on Amazon? Up there there is the worlds single largest collection of sellers competing for your business on price and user feedback. And when you are done, you point and click your way to fulfillment. And with the prospect of Amazon Prime (which includes free shipping) I can see more and more people do business on Amazon. To summarize, its not about earnings its about market share. I have no current position in AMZN, but will be watching as the stock approaches the previous high.

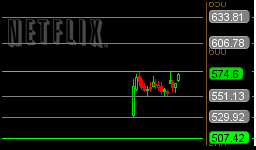

Last up is NFLX. After an upside earning surprise the stock has been consolidating just under the tree line at 574.60. But it seems determined to make a break to the upside and once it does, the next green line is overhead at 606. That's neatly a $30 move and could pay off quite well on a small (1 lot) option position.

To summarize, here are 3 fascinating and disruptive companies with the shares all within striking distance of new all-time highs. Watch them carefully and pounce when the time is right.

And have a great week ahead.

Now that NFLX has hit 616 what would you think of buying a Jun 15 put at 600? My thinking is NFLX seems to make a pull-back after these significant moves.

ReplyDeleteHi Optionstrader-

ReplyDeleteSorry for the delay in replying.

I would say that's a tough trade since NFLX has such a head of steam going, its hard to bet against it based on an arbitrary price level.

Instead I would wait for a really obvious setup before taking a trade. In other words, sit wait and watch and wait until you are 100% convinced you know what is going to happen (and it starts happening) before you trade. There are so many ways to lose money in options trading, that it doesn't make any sense to act until everything is working in your favor.

I know that sounds vague, but its my best advice and I hope it helps,

Chris

I am so happy investing with TD Ameritrade.. He has really helped after I lost my job. I started investing as little as $200 and now I earn over $2,500 weekly. So happy you can contact him on his Email: tdameritrade077@gmail.com

ReplyDeleteVia whatsapp: (+12166263236)