Welcome Back Active Traders and Wealth Builders.

One of the things I have learned from all of my years of investing and trading is that it doesn't pay to fight the market. Put another way, if the stock market is in retreat generally, odds are against making money on the long side in stocks. Sure you might find a few stocks or sectors making new all-time highs, but they will be few and far between. During these times, you hard eared assets are better just sitting in cash.

In his classic book 'Reminiscences of a Stock Operator' author Edwin Lefevre made a strong impression about observing

general conditions. Taking a cue from the author, here are my top reasons why I have the highest levels of cash I have had all year.

5) Market Breadth is Declining

Recent all-time highs in the SPY have not been confirmed by the broader market. The chart on the right shows a weekly chart of SPY for the past 2 years versus the T2107 which is a proprietary Worden indicator measuring the percent of stocks above their 200 day price moving average. You can clearly see a divergence between the SP-500 price and the percent of stocks above their 200 day moving average.

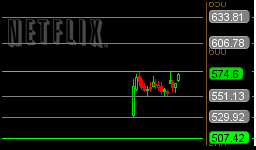

Keep in mind this is not a particularly new phenomenon and looking at the same chart for the past 10 years, the T2107 peaked back in mid-2009 at nearly 94% and currently stands at about 39%. In practice this means fewer stocks are taking the market higher and you know who they are, AAPL, AMZN and NFLX to name a few.

4) USD remains strong

The US dollar remains strong and is up about 7% for the year and up about 20% in the past 2 years as measured by the Dollar Index DXY. This is a mixed blessing since it makes our exports more expensive, but it makes the dollar buy more when US citizens travel abroad. Where is really hurts is the earnings of US-based multi-nationals who make a large portion of their sales outside the US. When those overseas earnings have to be translated back to the USD, the currency conversion cuts into profits. A strong dollar also makes Oil and Energy cheaper since its priced in USD which leads us to #3.

3) Oil and Commodities

Oil and Commodities in general have been in major bear markets, in part due a strong USD. In fact this past week oil prices actually pierced (to the downside) the lows made during the Financial Crisis of 2008. As an oil consumer, I love this trend because energy is one of the non-negotiable expenses of modern living and every drop in the price means more money I have to spend for other things. In fact, your humble blog author filled up his car (along with his portable gas can) this past week in Irvington, NJ for $2.18 a gallon cash!

Keep in mind that gasoline prices are very much a regional item. A quick look at the national Gas Price heat map

here shows that the Chicago area and most of the state of California have the highest prices in the country due in part to issues in refineries in the region.

So what does all this have to do with stock prices? The fact is about 30% of the SP-500 are energy companies and low energy prices do not help earnings of these companies. Take a look at long term charts of the Select Energy ETF (XLE) and SPY and you will see how closely correlated that the price of energy stocks are to the overall market.

2) China

The Chinese market as measured by FXI has had a spectacular round trip in 2015 rallying as much as 28% from late 2014 levels, just to give it all back.

To say Chinese government has an awkward relationship with Capitalism is putting it mildly. They

like the positives of market economies, growth and development and rising standard of living. They also like a rising stock market, but don't like when it goes down. So how does the Chinese government react to a falling market? They order people and companies to buy and prevent then from selling. This of course defeats one of the major benefits of investing in stocks to being with which is their liquidity. In the course of this fiasco, they have destroyed the faith of the people in the market. And it will take a long time to rebuild this faith given the fact that the Chinese public has little experience with stocks to begin with.

Now you could easily make the case that what goes on in China has a limited affect on the US. After all, the US markets didn't follow the Chinese market up and therefore should not follow it down. But the fact is that many large US companies (for example APPL and QCOM) get a large portion of their sales from China and a defensive consumer in China does not bode well for future earnings growth. Plus the world is more interconnected than ever and stock prices around the globe are highly correlated.

1) Seasonality

Its well known that stock prices typically suffer their biggest losses in September and October. I did a detailed study in seasonality back in 2013 in my post

Evidence of Autumn. The bottom line was that stocks to tend to decline in the fall, but guess what? They almost always end up higher for the year in the rally that follows between Thanksgiving and Christmas.

Granted stocks sometime rally in September and you may see a marginal new high in the SPY between now and the end of September. But don't buy into that rally, wait for things to get ugly in October and then buy when you see a close above the high of the low bar in your favorite stock or index.

0) The Fed

In all my years of playing the markets, I have never seen a Fed this easy for this long. Interest rates as measured by the Fed Funds rate have effectively been zero for the past 8 years. To see how extraordinary this is, look at this chart here

http://www.newyorkfed.org/charts/ff/. Of course, stocks love low rates which explains why they have done so well, effectively tripling since the lows of the Financial Crisis.

Now after years of speculation, it appears the Fed is ready to start raising rates in September. In fact, many have argued that the Fed has been too easy for too long and that an interest rate increase will actually signal the Fed has more faith in the economy and trigger a rally in stocks! But the rally will likely be short lived because higher rates are not a positive for stocks.

Overall, I don't want to give the impression of being bearish on stocks or the economy. I'm only suggesting that if you have some gains, take some profits and raise some cash. You will likely get better entry point in the next few months.

That's all for now, enjoy the fruits of your labors and have a great week ahead.